Smart Money Concept in Trading

Introduction

In the fast-paced world of trading, where fortunes can be made and lost in an instant, the concept of “Smart Money” stands as a beacon of hope for traders looking to maximise their returns. Smart Money in trading isn’t just about being intelligent with your investments; it’s about understanding market dynamics, making informed decisions, and strategically positioning your trades. In this comprehensive guide, we will delve deep into the Smart Money Concept in Trading, shedding light on its nuances, strategies, and how it can elevate your trading game.

Smart Money Concept in Trading

Smart Money Concept in Trading, often referred to as “Institutional Money” or “Big Money,” represents the capital deployed by seasoned professionals, institutional investors, and knowledgeable market participants. It’s the substantial capital that moves markets and influences price trends. Understanding and aligning with Smart Money is crucial for traders looking to secure consistent profits. Let’s explore this concept further.

The Significance of Smart Money Concept

Smart money is significant in trading because it tends to move the markets. Institutional investors, such as hedge funds, mutual funds, and large banks, often control substantial amounts of capital. When they make significant trading decisions, it can lead to significant market movements.

How Smart Money Concept Operates

Market Manipulation

One aspect of smart money is its ability to manipulate markets to its advantage. This manipulation can take various forms, such as spreading rumours, creating false signals, or executing large trades to influence market sentiment. Retail traders often fall victim to these tactics, making it crucial to be aware of them.

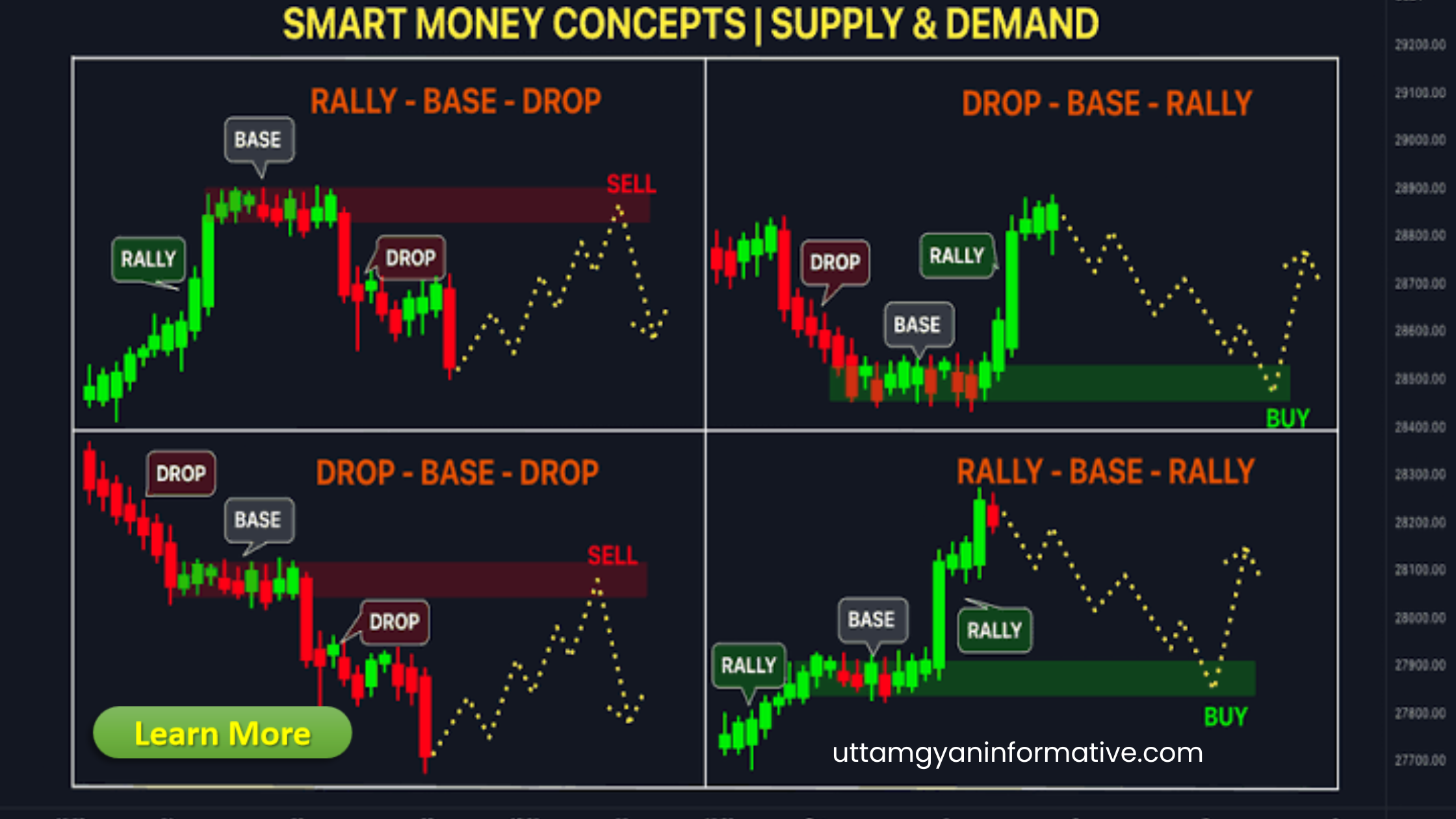

Accumulation and Distribution

Smart money follows a strategy of accumulation and distribution. They accumulate assets when prices are low and then distribute them when prices are high. This strategy allows them to maximise profits and minimise losses.

Following Institutional Ownership

One way retail traders can tap into the smart money concept is by tracking institutional ownership of assets. This information is often publicly available and can provide insights into where smart money is flowing. High institutional ownership can indicate confidence in an asset.

Sentiment Analysis

Analysing market sentiment is another tool in a trader’s arsenal. Smart money often uses sentiment indicators to gauge market mood. Traders can use sentiment analysis tools and techniques to align their strategies with prevailing market sentiment.

Technical Analysis

Smart money traders frequently rely on technical analysis to make informed decisions. They use charts, patterns, and technical indicators to identify potential entry and exit points. Retail traders can benefit from learning and applying these techniques.

The Power of Smart Money

Smart Money Concept in Trading wields significant influence for several reasons:

- Market Movers: Smart Money isn’t easily swayed by market noise. These entities possess the financial clout to move markets intentionally, creating trends that align with their positions.

- Informed Decisions: Institutional investors and professionals have access to extensive research, data, and analysis, allowing them to make well-informed trading decisions.

- Risk Management: Smart Money follows disciplined risk management strategies, mitigating losses effectively.

- Long-Term Perspective: Unlike retail traders who may be driven by short-term gains, Smart Money often adopts a long-term perspective, looking for sustainable growth.

- Diversification: Smart Money is typically spread across various asset classes, reducing exposure to a single market.

Identifying Smart Money Concept

Recognizing Smart Money movements can significantly benefit your trading strategy. Here’s how you can identify it:

- Volume Analysis: Monitor unusually high trading volumes, especially when they deviate from the norm. These spikes often indicate Smart Money activity.

- Price Patterns: Look for price patterns that are indicative of institutional trading strategies, such as accumulation or distribution phases.

- News and Events: Stay updated with financial news and events. Smart Money often enters or exits positions before major news releases.

- Options and Futures Activity: Pay attention to options and futures markets, where Smart Money often leaves footprints through large positions.

Strategies for Trading with Smart Money Concept

Trading alongside Smart Money requires a strategic approach. Here are some key strategies to consider:

- Follow the Trends: Smart Money tends to initiate and sustain trends. By identifying the direction in which Smart Money is moving, you can align your trades with these trends for higher chances of success.

- Volume Analysis: Analyse trading volumes meticulously. Sudden spikes or drops in volume can signal Smart Money activity. Trade in the same direction as the volume surge for potential profits.

- Sentiment Analysis: Track market sentiment through news, social media, and sentiment indicators. Smart Money often capitalises on market psychology, and understanding sentiment can give you an edge.

- Institutional Holdings: Keep an eye on institutional holdings and 13F filings. These reports disclose the positions of institutional investors, providing valuable insights into Smart Money movements.

Risks and Challenges

While the smart money concept can be a valuable tool, it’s not without risks. Traders should be cautious of blindly following institutional trades, as their goals and risk tolerances may differ significantly from those of retail traders. Additionally, market manipulation can lead to unexpected price swings.

Conclusion

The Smart Money Concept in Trading is a powerful tool for traders seeking to maximise returns and reduce risk. By understanding and aligning with the strategies of institutional investors and market professionals, you can navigate the complex world of trading with confidence. Remember, success in trading requires not just intelligence but also discipline, patience, and a deep understanding of market dynamics. Now that you’ve unlocked the secrets of Smart Money, it’s time to put this knowledge into action and elevate your trading game.

FAQs

Q: What distinguishes Smart Money from regular retail traders?

A: Smart Money represents large, informed institutional investors with the power to move markets intentionally. They follow disciplined strategies and have access to extensive research.

Q: Can individual traders benefit from Smart Money movements?

A: Yes, by identifying and aligning with Smart Money trends, individual traders can potentially benefit from their movements.

Q: Are there risks associated with trading alongside Smart Money?

A: Like any trading strategy, there are risks. It’s crucial to conduct thorough research and manage your risk effectively when trading with Smart Money.

Q: How can I track Smart Money activities?

A: You can track Smart Money through volume analysis, price patterns, news events, and institutional holdings.

Q: Is Smart Money always right in their trades?

A: No, Smart Money can be wrong, but their collective knowledge and resources often give them an advantage in the markets.

Q: Can retail traders compete with Smart Money?

A: While it can be challenging, retail traders can compete by staying informed, following trends, and using risk management strategies.