All You Need to Know About PMAY Scheme: Affordable Housing for All

Introduction

The dream of owning a house is a fundamental aspiration for millions of people around the world. In India, the government has taken significant steps to make this dream a reality for its citizens through various initiatives. One such notable scheme is the Pradhan Mantri Awas Yojana (PMAY) Scheme, a flagship program launched by the Government of India in 2015. PMAY aims to provide affordable housing to all urban and rural dwellers by the year 2022. In this article, we will explore the PMAY scheme in detail, including its eligibility criteria, types of subsidies, application process, benefits, and its impact on affordable housing.

Understanding the PMAY Scheme

The PMAY scheme is designed to address the housing needs of different sections of society, including economically weaker sections (EWS), low-income groups (LIG), and middle-income groups (MIG). It provides financial assistance and subsidies to eligible individuals and families to help them purchase or construct their own homes. The scheme emphasises the development of affordable housing units with basic amenities and infrastructure.

Eligibility Criteria

To avail the benefits of the PMAY scheme, applicants need to fulfil certain eligibility criteria. These criteria include income criteria and property ownership criteria.

Income Criteria

The PMAY scheme categorises individuals into different income groups based on their annual household income. The income criteria for each group are as follows:

- Economically Weaker Sections (EWS): Annual household income up to Rs. 3 lakh

- Low-Income Groups (LIG): Annual household income between Rs. 3 lakh and Rs. 6 lakh

- Middle-Income Group I (MIG I): Annual household income between Rs. 6 lakh and Rs. 12 lakh

- Middle-Income Group II (MIG II): Annual household income between Rs. 12 lakh and Rs. 18 lakh

Property Ownership Criteria

To be eligible for the PMAY scheme, the applicant or their family members should not own any pucca house (a house with a roof) in any part of India. This criterion ensures that the benefits reach those who are genuinely in need of affordable housing.

Types of PMAY Subsidies

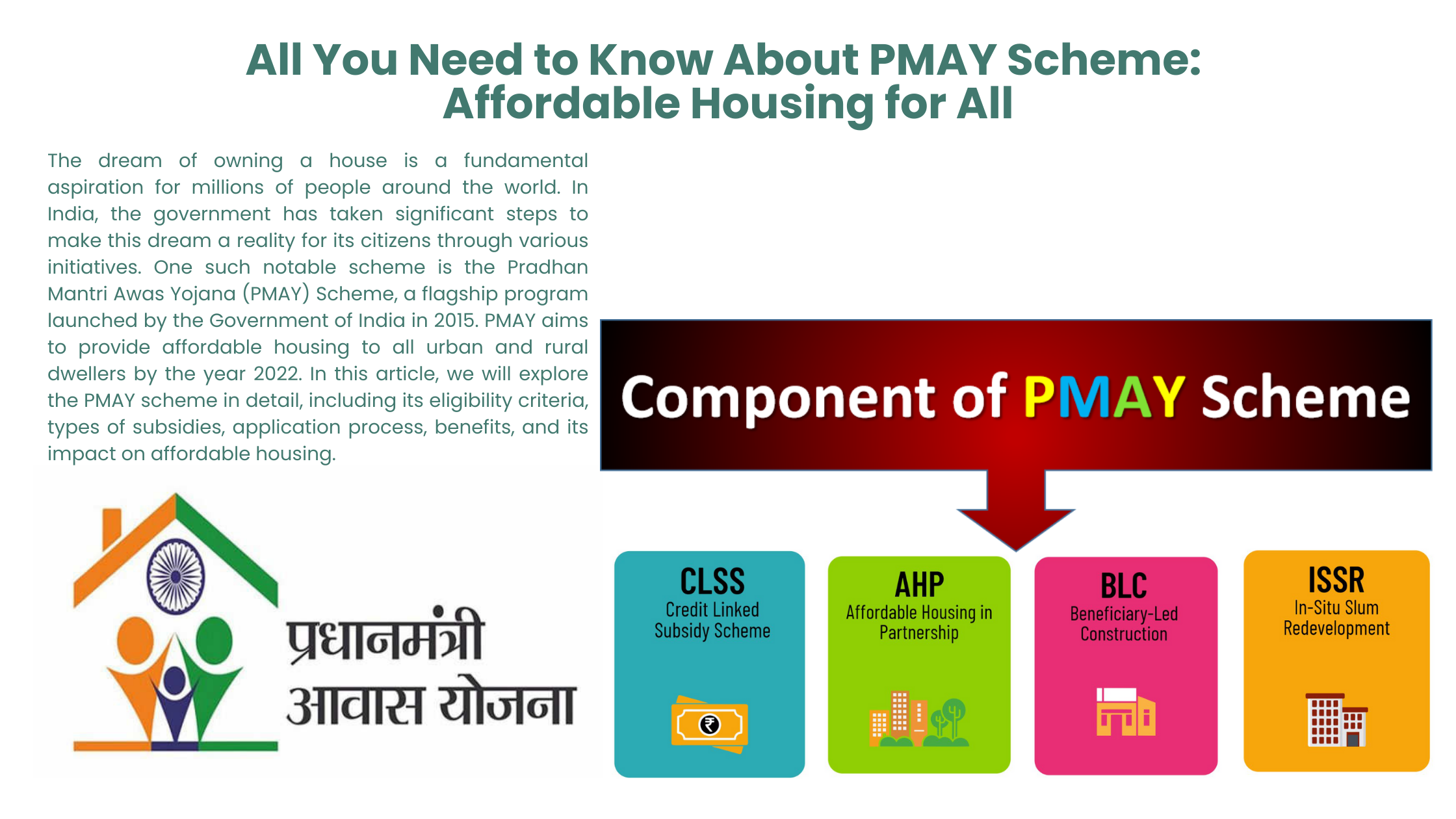

The PMAY scheme offers different types of subsidies to eligible beneficiaries, including:

Credit-Linked Subsidy Scheme (CLSS)

Under the CLSS, eligible applicants can avail interest subsidy on home loans. The subsidy is credited directly to the loan account, reducing the overall loan burden. The subsidy amount varies based on the income category, ranging from 3% to 6.5% on the loan amount.

Affordable Housing in Partnership (AHP)

The AHP component of PMAY focuses on public-private partnerships to develop affordable housing projects. It encourages the participation of private developers, NGOs, and other stakeholders in constructing affordable housing units.

Beneficiary-Led Construction (BLC)

The BLC component allows eligible beneficiaries to construct their own houses on their existing land. Financial assistance is provided to support self-construction or extension of existing houses.

In-Situ Slum Redevelopment (ISSR)

The ISSR component aims to improve the living conditions of slum dwellers by redeveloping the slum areas. It focuses on providing pucca houses to slum residents, along with basic amenities and infrastructure.

Application Process

To apply for the PMAY scheme, eligible individuals can visit the official website or approach the nearest Common Service Center (CSC). The application process involves filling out the application form and providing necessary documents, such as Aadhaar card, income proof, and property ownership proof. The applications are then verified and processed by the authorities.

Key Benefits of PMAY

The PMAY scheme offers several benefits to the beneficiaries, including:

- Financial assistance in the form of subsidies and interest rate reductions.

- Availability of home loans with lower interest rates.

- Enhancement of creditworthiness and eligibility for housing finance.

- Improved access to affordable housing units with basic amenities.

- Promotion of sustainable and inclusive urban development.

- Reduction in slum areas through in-situ redevelopment.

Impact of PMAY on Affordable Housing

The PMAY scheme has made a significant impact on the affordable housing sector in India. It has increased the availability of affordable housing options for individuals and families belonging to the EWS and LIG categories. The scheme has also stimulated the construction industry, generating employment opportunities and contributing to economic growth. Furthermore, the provision of affordable housing has improved the living standards and social well-being of beneficiaries

Success Stories

The PMAY scheme has witnessed numerous success stories across the country. Families that were once living in inadequate housing conditions have now been able to realise their dreams of owning a decent home. These success stories reflect the transformative impact of the PMAY scheme on the lives of people, bringing stability and security to their lives.

Challenges and the Way Forward

While the PMAY scheme has achieved remarkable success, it also faces certain challenges. Some of the challenges include delays in project implementation, limited awareness among potential beneficiaries, and difficulties in obtaining land for affordable housing projects. To address these challenges, the government needs to streamline the implementation process, improve awareness campaigns, and explore innovative solutions for land acquisition.

Conclusion

The Pradhan Mantri Awas Yojana (PMAY) Scheme is a groundbreaking initiative that aims to provide affordable housing to all sections of society. Through its various components and subsidies, the scheme has empowered individuals and families to fulfil their dream of owning a house. The PMAY scheme has not only addressed the housing needs but has also contributed to social and economic development. By Prioritising affordable housing, India takes a significant step towards creating inclusive and sustainable cities for its citizens.

FAQs

Q-1 How can I check if I am eligible for the PMAY scheme?

Ans. To check your eligibility for the PMAY scheme, you can visit the official PMAY website or consult the nearest Common Service Center (CSC).

Q-2 Can I avail multiple subsidies under the PMAY scheme?

Ans. No, beneficiaries can avail subsidies under only one component of the PMAY scheme, depending on their eligibility.

Q-3 Is there an age limit to apply for the PMAY scheme?

Ans. No, there is no specific age limit to apply for the PMAY scheme. Eligibility is primarily based on income and property ownership criteria.

Q-4 Can I apply for the PMAY scheme if I already own a house in a rural area?

Ans. Yes, you can apply for the PMAY scheme if you own a house in a rural area, provided you meet the income criteria and other eligibility requirements.

Q-5 What happens if I sell the PMAY-funded house within a few years?

Ans. If you sell the PMAY-funded house within a certain period (usually within 5 years), you may be liable to refund the subsidy amount as per the scheme’s terms and conditions.