Price Action in Trading

Introduction

In the fast-paced world of financial markets, mastering the art of trading is a goal many aspire to achieve. One of the essential tools in a trader’s arsenal is understanding Price Action in Trading. In this comprehensive guide, we’ll delve deep into the world of Price Action trading, unveiling strategies, techniques, and invaluable insights to help you become a more successful trader.

Price action is a fundamental concept in trading that focuses on analysing and making trading decisions based on the historical price movements of a financial asset, such as stocks, currencies, commodities, or cryptocurrencies. Traders who use price action strategies believe that all available information is already reflected in an asset’s price and that studying price patterns can provide valuable insights into future price movements.

Price Action in Trading

Price Action in Trading is a methodology that relies on analysing historical price movements to make informed trading decisions. Unlike many other trading strategies that involve complex indicators and algorithms, Price Action trading focuses on understanding market psychology through raw price data. It’s like deciphering the language of the market, where each candlestick, trendline, and pattern tells a story.

The Fundamentals of Price Action

To truly grasp Price Action trading, you need to start with the fundamentals. Here are the key concepts:

- Candlestick Patterns: Candlestick charts are commonly used in price action analysis. Each candlestick represents a specific time period (e.g., 1 minute, 1 hour) and displays the opening, closing, high, and low prices for that period. Traders look for patterns in these candlesticks, such as doji, hammers, and engulfing patterns, to anticipate reversals or continuations in price trends.

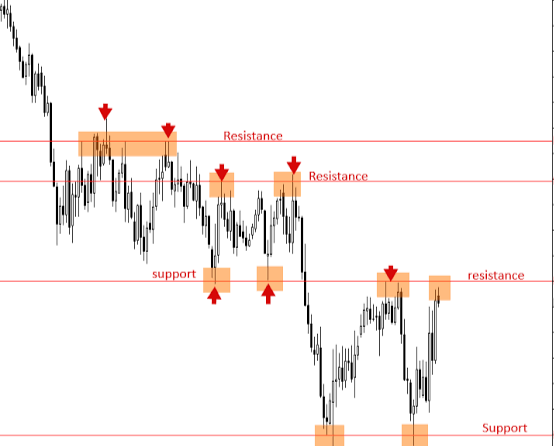

- Support and Resistance: Price action traders pay close attention to support and resistance levels. Support is a price level where an asset tends to find buying interest, preventing it from falling further. Resistance is a price level where selling interest often emerges, preventing the asset from rising further. These levels can help traders identify potential entry and exit points.

- Trends: Price action traders analyse the overall trend of an asset. They may use trendlines, moving averages, or simply observe the sequence of higher highs and higher lows in an uptrend or lower highs and lower lows in a downtrend. Identifying the trend helps traders decide whether to go long (buy) or short (sell) an asset.

- Risk Management: Effective risk management is non-negotiable in trading. Price Action traders use stop-loss orders and position sizing to protect their capital. This discipline ensures that losses are controlled, allowing for long-term success.

- Chart Patterns: Price action traders often study chart patterns like head and shoulders, double tops, and flags. These patterns can provide insights into potential trend reversals or continuations.

- Volume Analysis: Volume is a crucial element of price action analysis. High volume often accompanies strong price movements, suggesting increased market participation and potential confirmation of a trend. Low volume may indicate weak interest or a potential reversal.

- Breakouts and Pullbacks: Traders look for breakouts (when price moves above a significant resistance level) and pullbacks (temporary retracements within a trend) to enter or exit trades. Breakouts can signify strong momentum, while pullbacks can offer better entry points.

- Risk Management: Effective risk management is vital in price action trading. Traders use stop-loss orders to limit potential losses and position sizing to control risk exposure.

- Psychology and Sentiment: Understanding market psychology and sentiment is key to price action trading. Traders often analyse market sentiment indicators like the VIX (volatility index) and news events to gauge market sentiment and potential price reactions.

- Timeframes: Price action analysis can be applied to various timeframes, from short-term intraday trading to long-term investing. Traders choose timeframes that align with their trading goals and strategies.

- Continuous Learning: Successful price action traders continuously learn and adapt. They refine their strategies based on their experiences and market conditions.

Advanced Price Action Strategies

Once you’ve mastered the basics, you can explore advanced Price Action strategies:

- Price Action Patterns: Beyond simple candlestick patterns, there are more complex formations like head and shoulders, flags, and pennants. Recognizing these patterns can provide advanced signals for trading decisions.

- Multiple Time Frame Analysis: Price Action traders often use multiple time frames to gain a holistic view of the market. By analysing both short-term and long-term charts, they can make more informed decisions.

- Fibonacci Retracement: Fibonacci retracement levels are instrumental in identifying potential reversal points. Price Action traders combine these levels with other technical analysis tools for precise entries and exits.

The Psychology of Price Action

Trading is not just about numbers; it’s about understanding human psychology. Price Action traders learn to interpret market sentiment and trader behaviour through price movements. They understand that fear and greed drive the markets and use this knowledge to their advantage.

Conclusion

Price action trading doesn’t rely on indicators or complex algorithms; instead, it emphasises understanding and interpreting price movements. It requires discipline, patience, and the ability to make informed decisions based on observed patterns and market dynamics. Traders often combine price action analysis with other technical and fundamental analysis methods to enhance their trading strategies.

FAQs

How can Price Action benefit my trading?

Price Action trading simplifies the decision-making process by focusing on real-time price movements. It helps you understand market sentiment and make informed trading decisions.

Is Price Action suitable for beginners?

Yes, Price Action is a versatile strategy suitable for traders of all levels. Beginners can start with the basics and gradually move to more advanced techniques.

Are there any recommended resources for learning Price Action?

Several books and online courses cover Price Action trading. It’s essential to choose resources from reputable sources to build a strong foundation.

Can Price Action be combined with other trading strategies?

Absolutely. Price Action can complement other strategies like trend following or momentum trading, enhancing your overall trading toolkit.

How do I practice Price Action?

Practice is key. Start with a demo account to apply Price Action principles without risking real capital. As you gain confidence, transition to live trading.

What’s the secret to success in Price Action trading?

There’s no one-size-fits-all answer, but discipline, continuous learning, and a deep understanding of market psychology are crucial elements of success.

I do not even know how I ended up here but I thought this post was great I dont know who you are but definitely youre going to a famous blogger if you arent already Cheers.

Thank you so much for your valuable feedback, please share the article whose are needed.

Wow superb blog layout How long have you been blogging for you make blogging look easy The overall look of your site is magnificent as well as the content.

Thank you so much for your valuable feedback, please share the article whose are needed.

I truly relished the effort you’ve put in here. The sketch is stylish, your authored material chic, however, you seem to have developed some anxiety about what you intend to deliver subsequently. Assuredly, I will revisit more regularly, akin to I have nearly all the time, in the event you maintain this rise.

Thank you so much for your valuable feedback, please share the article whose are needed.

Thank you so much for your valuable feedback, please share the article whose are needed.

I truly appreciated the work you’ve put forth here. The sketch is tasteful, your authored material stylish, yet you appear to have developed some nervousness regarding what you intend to deliver next. Rest assured, I’ll return more regularly, much like I’ve done almost constantly, should you maintain this upward trajectory.

Thank you so much for your valuable feedback, please share the article whose are needed.

This website is an absolute gem! The content is incredibly well-researched, engaging, and valuable. I particularly enjoyed the [specific section] which provided unique insights I haven’t found elsewhere. Keep up the amazing work!

Thank you so much for your valuable feedback, please share the article whose are needed.

What a fantastic resource! The articles are meticulously crafted, offering a perfect balance of depth and accessibility. I always walk away having gained new understanding. My sincere appreciation to the team behind this outstanding website.

Thank you so much for your valuable feedback, please share the article whose are needed.