Top 10 Candlestick Patterns

Introduction

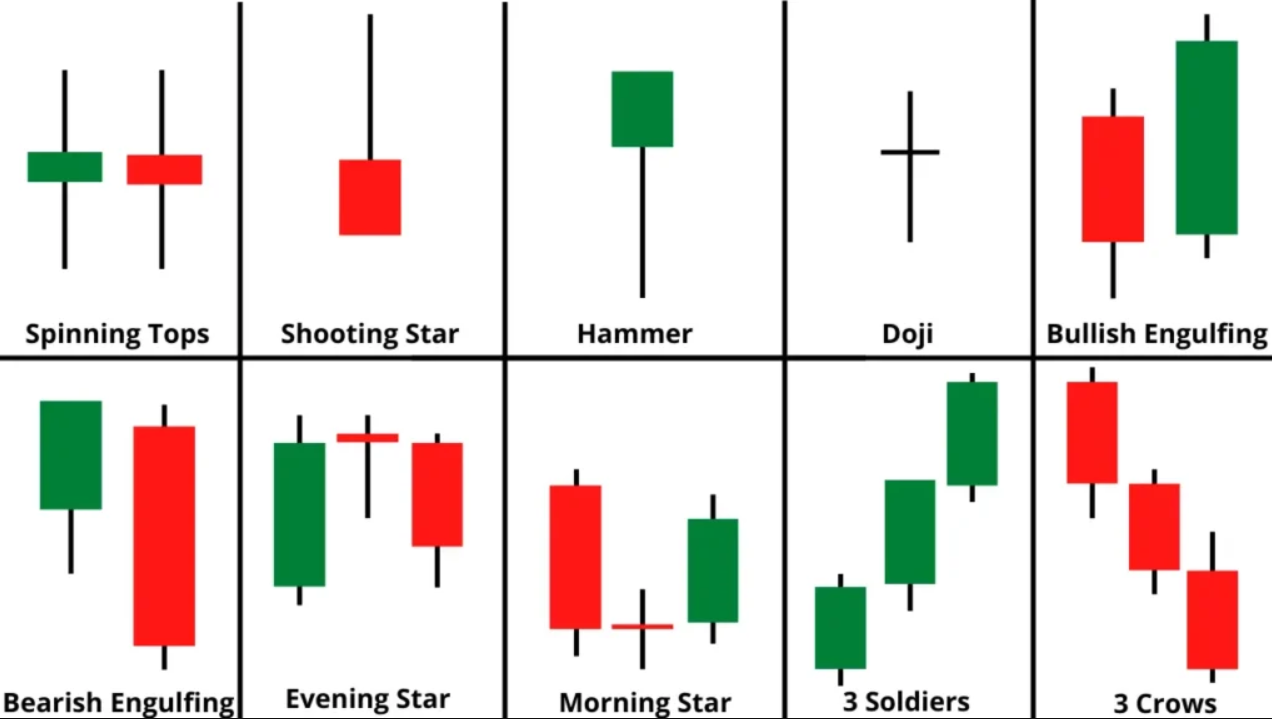

Candlestick patterns are graphical representations of price movements within a specific time frame. They originated in Japan and have become an integral part of technical analysis in modern trading. By observing these patterns, traders can predict potential market reversals, trend continuations, and even the sentiment of market participants.

What Are Candlestick Patterns?

Candlestick patterns consist of one or more candlesticks on a price chart. Each candlestick has four main components: the opening price, closing price, highest price (high), and lowest price (low) within a given time period. The shape and arrangement of these candlesticks create patterns that provide insights into price trends.

The Importance of Candlestick Patterns in Trading

Candlestick patterns offer traders a visual representation of market behavior. They help traders gauge the battle between buyers and sellers and provide clues about potential price movements. Whether you’re a day trader, swing trader, or long-term investor, understanding candlestick patterns can enhance your decision-making process.

Bullish Candlestick Patterns

Hammer:

Imagine a little hammer on your price chart. This pattern looks like a candlestick with a small body at the top and a long stick-like shadow below. It’s as if the price took a hit but managed to bounce back. This suggests that even though sellers tried to push the price down, buyers stepped in and saved the day. It’s like a sign that a bullish comeback might be on the horizon.

Bullish Engulfing:

Think of this pattern as a big hungry monster that swallows the previous candlestick. It happens when a small red candlestick is completely covered by a larger green one in the next session. It’s like the bears were having a party, but suddenly the bulls showed up with a feast. This usually indicates a shift from a downtrend to an uptrend, like the bulls taking over.

Piercing Pattern:

Picture this as a brave knight piercing through a castle wall. It starts with a red candlestick followed by a green one that opens below the previous day’s close. But wait, it doesn’t stop there! The green candlestick goes on to close at least halfway up the red one. This can be seen as a strong signal that the bears’ defence is weakening and the bulls might be ready to charge in.

Morning Star:

Imagine the night sky turning into a bright morning. This pattern forms with three candlesticks. First, there’s a red one representing the darkness. Then, a smaller candlestick appears, like a transitional phase. Finally, a big green candlestick emerges, like the morning sun breaking through. It’s a beautiful sight that suggests the bears are losing control and the bulls are gaining momentum.

Three White Soldiers:

Picture a trio of brave soldiers marching triumphantly. This pattern is made up of three consecutive green candlesticks with increasing opening prices. It’s like a show of strength from the bulls, as they keep pushing the price higher and higher. This usually indicates a strong uptrend, as if the bulls are celebrating their victory.

These candlestick patterns are like little stories that traders read from the charts. They give us insights into the battle between buyers and sellers and help us predict potential price movements. Remember, while these patterns can be quite reliable, it’s always a good idea to consider other factors and indicators before making any trading decisions.

Bearish Candlestick Patterns

Shooting Star:

Imagine a star that appears in the evening sky, but it’s not shining as brightly as you’d expect. This pattern looks like a candlestick with a small body at the bottom and a long shadow on top, resembling the shape of a shooting star. It’s like a signal that the price reached for the stars but couldn’t quite make it. This could indicate a potential reversal from an uptrend to a downtrend

Bearish Engulfing:

Think of this pattern as a big, gloomy cloud engulfing a sunny day. It occurs when a small green candlestick is completely covered by a larger red one in the next session. It’s like the bulls were having a nice time, but suddenly the bears showed up and cast a shadow. This often suggests a shift from an uptrend to a downtrend, with the bears taking charge.

Dark Cloud Cover:

Picture this as a sudden cloud cover dimming the sky after a bright day. This pattern starts with a green candlestick, indicating positivity. But then, the next day’s red candlestick opens above the previous day’s close and goes on to close at least halfway down the green one. It’s like a warning sign that the bears are moving in and could be about to rain on the bulls’ parade.

Evening Star:

Imagine the sky transitioning from a beautiful day to a starry night. This pattern forms with three candlesticks. First, there’s a big green one, representing a bright day. Then, a smaller transitional candlestick appears. Finally, a red candlestick arrives, signalling the end of the positive trend. It’s like the bears are taking over as the sun sets, indicating a potential reversal.

Three Black Crows:

Picture a group of three black crows circling in the sky. This pattern consists of three consecutive red candlesticks with decreasing opening prices. It’s like a gathering of pessimistic crows signalling bad news. This pattern suggests a strong downtrend, as the bears keep pushing the price lower and lower.

Remember, these bearish candlestick patterns are like cautionary tales in the trading world. They provide insights into the tug of war between buyers and sellers and can help predict possible price movements. However, it’s important to consider other factors and indicators before making any trading decisions, as patterns alone might not always tell the whole story.

Reversal Patterns:

Doji:

Imagine a candlestick that’s unsure which way to go. The Doji pattern forms when the opening and closing prices are nearly the same, creating a small body. It’s like a sign of balance between buyers and sellers, as if they’re having a conversation but haven’t reached a decision yet. This often suggests a potential trend reversal, like a pause in the action before a possible change in direction.

Tweezer Bottoms and Tops:

Think of this as a pair of matching shoes left at the door. Tweezer Bottoms occur when two candlesticks have the same low price, indicating a potential reversal from a downtrend. Tweezer Tops happen when two candlesticks share the same high price, signalling a potential reversal from an uptrend. It’s like the market leaving a hint that the current trend might be about to shift.

Rising Three Methods:

Imagine a group of friends helping each other climb up a steep hill. This pattern involves a long bullish candlestick followed by three smaller bearish ones. However, the bearish candles are within the range of the first green one. It’s like a brief pause in the upward journey, as if the market is catching its breath before resuming the climb.

Falling Three Methods:

Picture a group of friends descending a staircase together. In this pattern, a long bearish candlestick is followed by three smaller bullish ones, all within the range of the first red one. It’s like a temporary halt in the downward movement, as if the market is taking a break before continuing its descent.

These reversal and continuation patterns are like stories unfolding on your price chart. They offer insights into potential shifts in market sentiment and trends. However, remember that these patterns work best when combined with other forms of analysis. The market is full of surprises, so using these patterns alongside other tools can help you make more informed trading decisions.

How to Identify and Use Candlestick Patterns

Candlestick patterns might seem like puzzles, but with a bit of practice, you can become a pro at spotting them and using them to your advantage in trading. Here’s how to go about it:

- Learn the Basics: Before diving in, understand the different types of candlestick patterns. Familiarise yourself with bullish, bearish, reversal, and continuation patterns. Each has its own unique characteristics.

- Use Charts: Candlestick patterns are best observed on price charts. Many trading platforms offer different chart types, such as candlestick charts. These visuals will help you see the patterns more clearly.

- Timeframes: Different patterns work better on different timeframes. Some are more effective on shorter timeframes, like intraday trading, while others are more reliable on longer timeframes. Experiment to find what suits your style.

- Combine with Indicators: Candlestick patterns work well when combined with other technical indicators like moving averages, MACD, or RSI. This gives you a more comprehensive view of the market.

- Practice Pattern Recognition: Start with the basics. Look for straightforward patterns like hammers, dojis, and engulfing patterns. Gradually move on to more complex ones as you get comfortable.

- Focus on Context: Don’t view patterns in isolation. Consider the overall trend, support and resistance levels, and market news. Context is key to accurate interpretation.

- Confirmation: Don’t jump the gun. Wait for confirmation. A single candlestick might not provide enough information. Wait for the next candlestick to validate the pattern.

- Risk Management: Patterns are tools, not crystal balls. Apply proper risk management. Set stop-loss orders to protect your investments from unexpected market movements.

- Paper Trading: If you’re new to trading, consider practicing with paper trading. It’s a simulation of real trading that helps you refine your skills without risking real money.

- Keep Learning: The world of trading is dynamic. Keep learning and stay updated about new patterns and their applications. Attend webinars, read books, and follow experienced traders.

Using Candlestick Patterns in Trading:

- Entry and Exit Points: Candlestick patterns can help you identify optimal entry and exit points for your trades. For instance, a bullish engulfing pattern might signal a good time to enter a long trade.

- Trend Reversals: Patterns like evening stars or shooting stars can warn you of potential trend reversals, helping you avoid losses in unfavourable market conditions.

- Confirmation: Use candlestick patterns to confirm your analysis. If other indicators suggest a bullish trend and a bullish pattern appears, it could provide additional confidence.

- Risk Assessment: Certain patterns offer insights into the market sentiment. For example, a doji could indicate uncertainty, prompting you to be cautious.

- Timing: Candlestick patterns can assist in timing your trades. For instance, a continuation pattern might suggest that the ongoing trend is likely to persist, allowing you to ride the wave.

Remember, while candlestick patterns are valuable tools, they’re not foolproof. Use them in conjunction with other forms of analysis and always be prepared for unexpected market moves. Practice, patience, and a clear understanding of the patterns will help you make more informed trading decisions.

Best Practices for Incorporating Candlestick Patterns in Your Trading Strategy

- Combine with Other Analysis: While candlestick patterns provide valuable insights, they work best when combined with other technical indicators and fundamental analysis. This comprehensive approach helps confirm your trading decisions.

- Focus on Strong Signals: Not all candlestick patterns are equally reliable. Prioritise well-established and commonly recognized patterns like engulfing patterns, hammers, and dojis. These tend to offer stronger signals.

- Consider Timeframes: Different timeframes yield different patterns. Pay attention to the timeframe you’re trading on, as patterns might appear differently on daily, hourly, or minute charts.

- Confirm with Volume: Volume is an essential factor in confirming the validity of a candlestick pattern. Higher trading volumes during the formation of a pattern can strengthen its signal.

- Multiple Timeframes: Look for consistent patterns across multiple timeframes. For instance, if a bullish pattern appears on both a daily and a weekly chart, it adds more weight to the potential trade.

- Market Conditions: Assess the broader market conditions. In a strong trend, continuation patterns might be more reliable, while in a ranging market, reversal patterns could carry more significance.

- Practice Patience: Don’t rush into a trade solely based on a single pattern. Wait for confirmation from subsequent candlesticks before making your move.

- Set Realistic Targets: Understand the potential price movement a pattern might indicate. Set realistic profit targets and stop-loss levels to manage risk effectively.

- Avoid Overtrading: Not every candlestick pattern requires a trade. Overtrading can lead to losses. Be selective and only take trades that align well with your strategy.

- Backtesting: Use historical data to backtest your strategy. This helps you evaluate how well the patterns have worked in the past and adapt your approach accordingly.

- Adapt to Market Changes: Market conditions evolve. Be ready to adjust your strategy if certain patterns start losing their effectiveness.

- Stay Informed: Continuously educate yourself about new patterns and variations. The trading landscape evolves, and staying informed keeps you ahead of the curve.

- Keep a Trading Journal: Document your trades, noting the patterns you used, the outcomes, and any lessons learned. This helps you track your progress and refine your strategy over time.

- Emotional Control: Stick to your trading plan even if a pattern doesn’t play out as expected. Emotional decision-making can lead to impulsive actions and losses.

- Risk Management: Always prioritise risk management. Never risk more than you can afford to lose on a single trade, regardless of how strong a pattern’s signal might seem.

Incorporating candlestick patterns into your trading strategy takes practice and a disciplined approach. Remember that patterns aren’t foolproof predictions, but they can significantly enhance your decision-making process when used responsibly.

Common Mistakes to Avoid

- Overreliance on Patterns: Relying solely on candlestick patterns without considering other technical indicators and fundamental analysis can lead to poor trading decisions.

- Ignoring Market Context: Failing to consider the broader market conditions, trends, and news can result in misinterpretation of patterns and wrong trading choices.

- Chasing After Every Pattern: Trading every single pattern that appears can lead to overtrading and increased exposure to risk. Select patterns that align with your strategy.

- Ignoring Timeframes: Different timeframes can show different patterns. Ignoring this variability can lead to inaccurate assessments and wrong predictions.

- Lack of Confirmation: Failing to wait for confirmation from subsequent candlesticks before entering a trade can result in premature or misguided decisions.

- Ignoring Volume: Volume can validate or invalidate the significance of a pattern. Neglecting volume can lead to false signals and unexpected outcomes.

- Disregarding Risk Management: Overcommitting to a trade based solely on a pattern’s signal without setting appropriate stop-loss orders can lead to significant losses.

- Not Adapting to Changing Markets: Market conditions evolve over time. Not adjusting your strategy to changing market dynamics can lead to poor performance.

- Trading Without a Plan: Trading without a well-defined plan, including entry and exit points, profit targets, and risk management strategies, can result in impulsive decisions.

- Emotional Trading: Letting emotions, such as fear and greed, drive your trading decisions rather than sticking to your well-thought-out plan can lead to inconsistent results.

- Blindly Following Patterns: Blindly following patterns without understanding their underlying meanings can lead to incorrect interpretations and trading errors.

- Neglecting Fundamental Analysis: While technical analysis is crucial, ignoring fundamental factors that can influence market movements can lead to unexpected outcomes.

- Lack of Patience: Impatiently entering trades before patterns are fully formed and confirmed can result in false signals and losses.

- Not Learning from Mistakes: Failing to learn from past trading mistakes and adjusting your strategy accordingly can hinder your progress as a trader.

- Overconfidence: Excessive confidence in your ability to read patterns can lead to overlooking important details and making risky decisions.

Incorporating candlestick patterns into your trading strategy requires a balanced approach, constant learning, and a willingness to adapt. By avoiding these common mistakes and staying disciplined, you can enhance your trading accuracy and overall success.

Conclusion

Incorporating candlestick patterns into your trading strategy can significantly improve your accuracy in predicting price movements. Remember that these patterns are most effective when used in conjunction with other technical and fundamental analysis tools. Continuous learning and practice are key to mastering the art of reading candlestick patterns.

FAQs

Are candlestick patterns applicable to all financial markets?

Yes, candlestick patterns are widely used in various financial markets, including stocks, forex, commodities, and cryptocurrencies.

Can candlestick patterns be used alone for trading decisions?

While candlestick patterns provide valuable insights, it’s recommended to use them alongside other technical indicators and fundamental analysis.

Do candlestick patterns work on all timeframes?

Candlestick patterns can be effective on different timeframes, but their significance may vary. It’s essential to adapt your analysis based on the timeframe you’re trading.

How do I learn to identify candlestick patterns?

There are numerous online resources, books, and courses dedicated to teaching candlestick pattern recognition. Practice on historical charts can also enhance your skills.

What is the best way to avoid common mistakes in interpreting candlestick patterns?

Keeping a trading journal, seeking guidance from experienced traders, and continuous learning can help you avoid common pitfalls in pattern interpretation.

Open a Demat Account: https://app.groww.in/v3cO/sorzhken