Maintain a Good Credit Score from the Start

Introduction

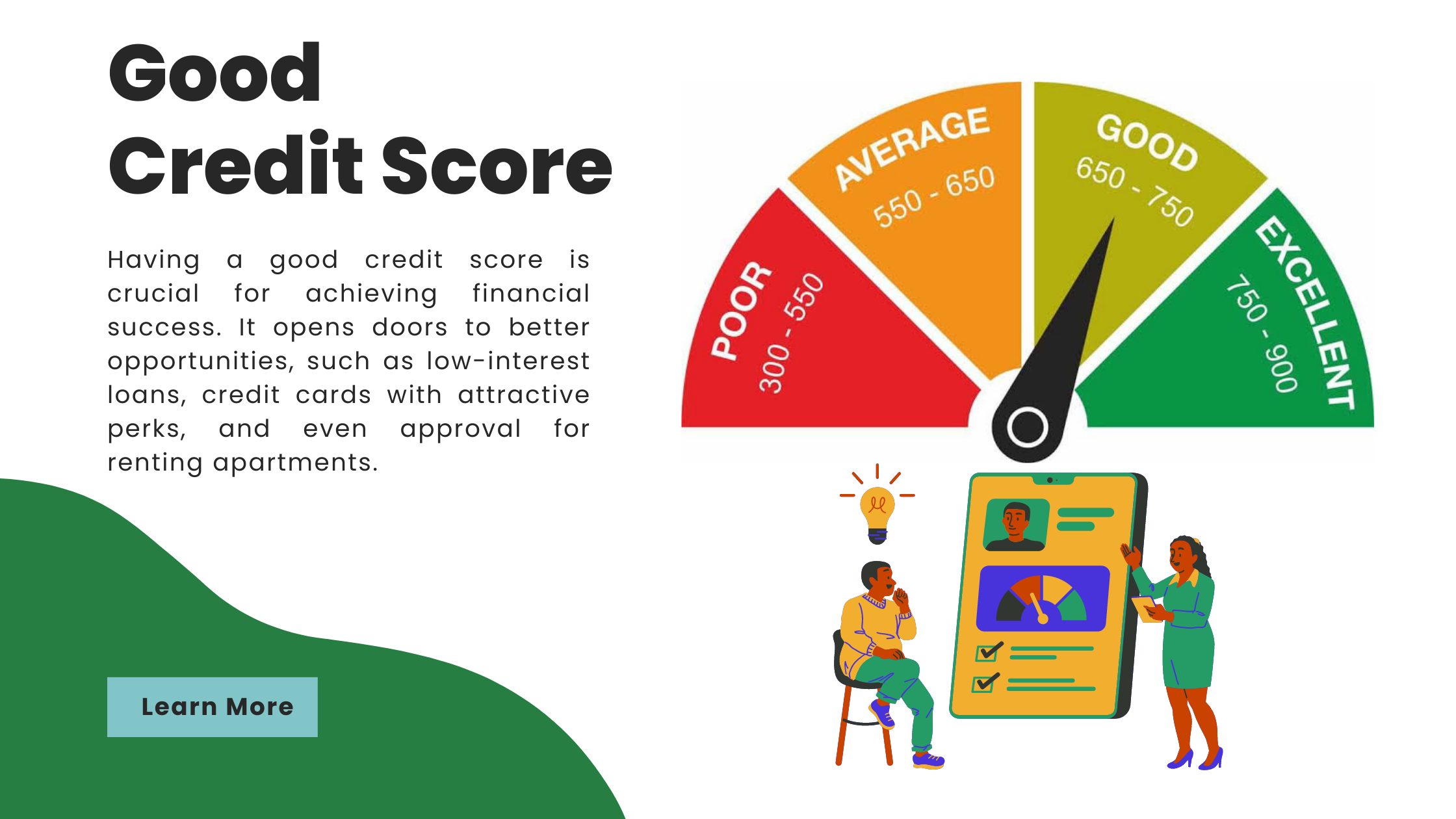

Having a good credit score is crucial for achieving financial success. It opens doors to better opportunities, such as low-interest loans, credit cards with attractive perks, and even approval for renting apartments. Building and maintaining a solid credit score from the beginning is essential for a strong financial foundation. In this guide, we will explore the step-by-step process of establishing and nurturing your credit score to ensure a bright financial future.

Understanding the Importance of a Good Credit Score

A good credit score is not just a number; it is a key that unlocks numerous financial opportunities and benefits. Whether you’re applying for a mortgage, seeking an auto loan, or even applying for a new job, your credit score plays a pivotal role in determining your financial health and credibility. Let’s delve into why having a good credit score is crucial:

- Access to Better Credit Options: When you have a good credit score, you become an attractive prospect for lenders. They view you as a responsible borrower who is likely to repay debts on time. As a result, you gain access to better credit options with lower interest rates and more favourable terms. This means you’ll save money on interest payments and have more affordable monthly instalments.

- Lower Interest Rates: One of the most significant advantages of a good credit score is the ability to secure loans and credit cards with lower interest rates. Lenders reward borrowers with higher credit scores because they pose lower credit risks. Consequently, you’ll be eligible for loans with competitive interest rates, helping you save substantial amounts of money over the loan’s duration.

- Credit Card Perks and Rewards: Credit cards that offer attractive perks and rewards are usually reserved for individuals with good credit scores. These perks can include cashback, airline miles, or discounts on purchases. Responsible credit card usage and timely payments enable you to take advantage of these enticing benefits.

- Easier Approval for Rental Properties: Landlords and property management companies often check the credit history of potential tenants to assess their financial responsibility. With a good credit score, you increase your chances of getting approved for your dream rental property, as it demonstrates that you are reliable and can handle your financial commitments.

- Higher Credit Limits: A good credit score not only increases your chances of getting approved for credit but also enables you to receive higher credit limits on your credit cards. Higher credit limits provide you with greater financial flexibility and can positively impact your credit utilisation ratio, further boosting your credit score.

- Employment Opportunities: Certain employers consider credit checks as part of their hiring process, especially for positions that involve handling finances or sensitive information. A good credit score can give potential employers confidence in your financial responsibility and integrity, potentially giving you an edge over other candidates.

- Qualification for Insurance Premium Discounts: Believe it or not, your credit score can also influence the cost of your insurance premiums. Insurance companies may use credit-based insurance scores to assess risk. With a good credit score, you may be eligible for lower insurance premiums, which can lead to significant savings over time.

- Building Financial Confidence: A good credit score not only provides you with tangible benefits but also instils financial confidence in you. Knowing that you have a strong credit history and can manage credit responsibly empowers you to take control of your financial future and make informed decisions.

In conclusion, a good credit score is an essential asset that can significantly impact your financial well-being and opportunities. By understanding the importance of maintaining a good credit score, you can take proactive steps to build and sustain a positive credit history. Remember, good credit habits and responsible financial management are key to achieving a strong credit score and securing a brighter financial future.

How Credit Scores Are Calculated

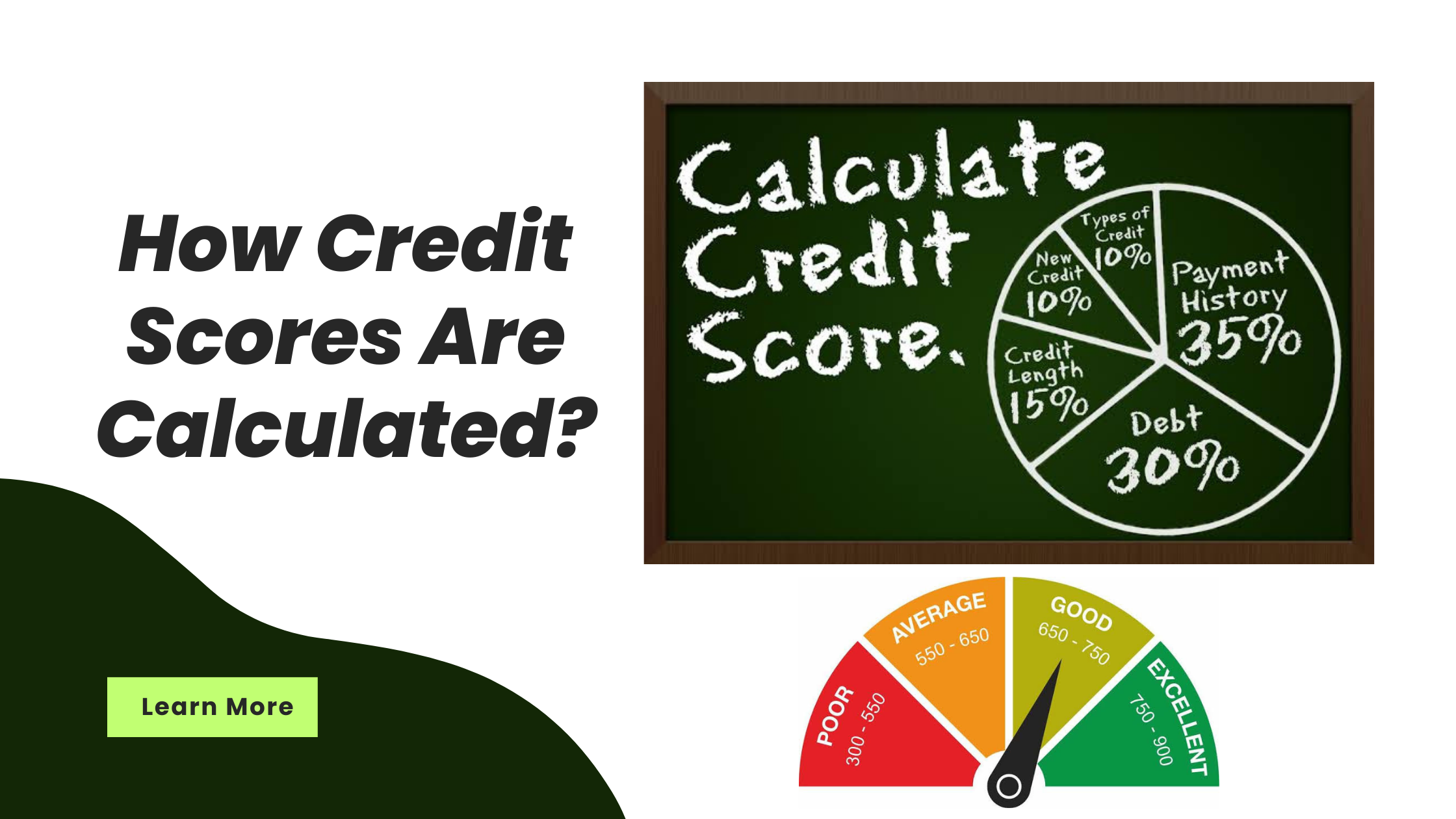

Alright, let’s uncover the secret sauce behind those credit scores! These three-digit numbers hold so much power, and knowing how they are calculated can be a game-changer for your financial journey. So, let’s break it down in plain English:

- Payment History: This one’s a biggie! Making your payments on time is like a gold star for your credit score. Lenders love to see responsible borrowers who don’t miss due dates. So, set those reminders and pay those bills like a champ!

- Credit Utilisation: Picture this: you have a bucket of credit, and how much water you put in it matters! Credit utilisation is all about how much of your available credit you use. The lower, the better. Keeping it in check shows lenders you’re not stretching your limits.

- Length of Credit History: Time matters! The longer your credit history, the more data there is for lenders to gauge your creditworthiness. So, if you’ve been a responsible credit user for a while, you’re already on the right track.

- Credit Mix: Variety is the spice of life, and it’s no different with credit accounts. Having a mix of different types of credit, like credit cards and loans, can actually work in your favour. It shows you can handle various financial responsibilities.

- New Credit: Easy does it! Opening multiple new credit accounts in a short span can raise some eyebrows. It might make lenders wonder why you suddenly need so much credit. So, be strategic and don’t rush into multiple applications all at once.

Now that you’ve got the inside scoop on how credit scores are calculated, you’re better equipped to make smart credit decisions. Keep those payments on point, watch your credit utilisation, and let time work its magic on your credit history. Remember, building a solid credit foundation takes time and responsible credit management. So, go out there and conquer your credit game like a pro!

Establishing Credit from Scratch

Alright, so you’re starting from square one with no credit history. Don’t worry; we’ve got your back! Building credit might seem like a daunting task, but with the right approach, you’ll be on your way to establishing a solid credit foundation. Let’s dive in and explore some smart strategies to kickstart your credit journey:

- Open a Secured Credit Card: Think of this as your credit training wheels. A secured credit card works by requiring a deposit upfront, which becomes your credit limit. It’s a win-win; you get to build credit while having control over your spending. Just remember to make those payments on time and keep your credit utilisation in check!

- Become an Authorised User: Got a family member or friend with good credit? Ask them to add you as an authorised user on one of their credit cards. By piggybacking on their good credit, you can start building your own credit history. Just make sure it’s someone you trust, as their credit habits can affect your credit journey too.

- Consider Credit Builder Loans: These loans are like your stepping stones to credit glory. Designed specifically to help folks like you build credit, credit builder loans work a bit differently. Instead of getting the money upfront, you make payments into a savings account, and once you’ve paid it off, you get the funds. It’s like a reverse loan that helps you prove your creditworthiness.

Remember, patience is key when it comes to establishing credit. Your credit score won’t skyrocket overnight, but with responsible credit habits and a little time, you’ll start seeing those numbers climb. So, embrace the credit-building journey and take those first steps towards a brighter credit future! You’ve got this!

Responsible Credit Card Usage

Credit Cards – those little plastic wonders that can either be a blessing or a curse for your credit score. But fear not, we’ve got some golden rules to help you wield your credit card power responsibly. Let’s dive into the secrets of being a credit card ninja:

- Pay on Time, Every Time: This is like the golden rule of credit cards. Timely payments are the magic potion that boosts your credit score and keeps lenders smiling. So, mark those due dates on your calendar, set reminders, or do whatever it takes to ensure you never miss a payment.

- Keep Credit Utilisation Low: Picture this: you have a credit limit, and it’s like a cozy little blanket. The trick is not to stretch it too much! Aim to use only a small percentage of your available credit. Keeping that utilisation low shows lenders that you’re a responsible credit user.

- Avoid Carrying Balances: This one’s a game-changer! Say goodbye to those pesky interest charges by paying off your credit card balance in full each month. Not only will you save money, but you’ll also show creditors that you’ve got this credit thing under control.

And there you have it – the credit card commandments for a successful credit journey! By following these simple yet powerful rules, you’ll not only build credit like a pro but also enjoy the perks and benefits that come with responsible credit card usage. So, go forth and swipe smartly, my friend! Your credit score will thank you.

Building a Strong Credit History

As time ticks on, so does your credit history! It’s like a financial journey that keeps evolving, and there are extra steps you can take to make it even stronger. Let’s uncover these good credit score boosting moves:

- Apply for a Starter Credit Card: So, you’ve got a credit history now congrats! It’s time to level up and consider applying for a basic credit card. This next move shows creditors that you’re ready to handle more credit responsibly. Just remember to stick to those golden rules of responsible credit card usage we talked about earlier!

- Apply for a Student Loan: Calling all students! If you’re hitting the books, consider adding a student loan to your credit mix. Student loans are like credit-boosting fuel, as they contribute positively to your good credit score history. Responsible repayment can set you on the path to an even more impressive credit score.

- Monitoring Your Credit: It’s like keeping an eagle eye on your credit health! Regularly monitoring your credit is essential to ensure everything is accurate and legit. You can score a free credit report once a year from each of the three major credit bureaus. Go through it with a fine-tooth comb, checking for any errors or suspicious activities. If you spot something fishy, dispute it like a credit detective!

So, there you have it, the credit-building power-ups that’ll take your credit history to the next level. By taking these additional steps, you’re demonstrating to lenders that you’re a credit-savvy individual with a solid financial track record. Keep building those credit blocks, and your credit score will be soaring to new heights! Happy credit-building!

Avoiding Credit Pitfalls

We get it navigating the world of credit can be like tiptoeing through a minefield. But fear not, for we’re here to guide you away from those dangerous credit pitfalls. Let’s arm you with the knowledge to steer clear of these credit score wreckers:

- Missing Payments: Oh, the dreaded late or missed payments! They might seem innocent, but they can pack a serious punch to your credit score. Timely payments are like the superhero shield that protects your credit. So, be a credit hero and make those payments on time, every time!

- Maxing Out Credit Cards: Picture this – you’ve got a credit card with a spending limit, and it’s like a dance floor. You can’t have everyone on the dance floor at once; there’s got to be some space to move! Same goes for your credit card – avoid maxing it out as it can hurt your credit score. Keep those balances in check, and your credit score will be singing your praises.

- Applying for Too Much Credit: It’s like credit application overload! Multiple credit inquiries within a short span can leave a dent in your credit score. Lenders might wonder why you’re suddenly seeking so much credit. So, be strategic and don’t go on a credit application spree all at once.

Avoiding these credit traps is like protecting your good credit score fortress. By being mindful of your payment due dates, keeping credit card balances low, and being cautious with credit applications, you’re setting yourself up for credit success. Remember, it’s not just about what you do right; it’s also about avoiding those credit missteps. So, dodge those pitfalls like a credit ninja, and your good credit score will thank you for it!

Handling Debt and Credit Repayment

Alright, let’s face the reality – debt can be a bit of a beast, but fear not, for there are some savvy ways to tame it and take control of your financial destiny. Here are some smart strategies to handle debt and conquer credit repayment like a pro:

- Create a Repayment Plan: Think of this as your battle strategy against debt. Take a deep breath, gather all your debts, and organize them like a seasoned general. List them out and prioritise them based on interest rates or outstanding balances. Then, create a repayment plan that suits your budget. It’s like creating a roadmap to financial freedom!

- Consider Debt Consolidation: Ah, the hero known as debt consolidation! If you’ve got multiple high-interest debts, this might just be your secret weapon. Debt consolidation involves combining all those pesky debts into one single loan with a lower interest rate. It streamlines your repayments, making them more manageable and less overwhelming. You’ll feel like you’ve just unleashed a powerful ally against debt!

Remember, facing debt head-on and being proactive in your credit repayment journey is key to conquering it. It might take time, discipline, and some battle scars, but with a solid repayment plan and strategic debt consolidation, you’ll be well on your way to financial victory and maintain your good credit score.

When to Seek Professional Help

We all face challenges now and then, and credit issues can be a tough nut to crack. But you don’t have to face them alone! If you find yourself in a credit conundrum, it’s okay to reach out for some professional assistance. Here are two avenues you can explore:

- Credit Counselling: Think of credit counselling as your credit lifeline! Credit counselling agencies are like friendly guides, offering expert advice and guidance on credit management as well as helping us to improve our good credit score. They’ll help you navigate the credit maze, create a personalised action plan, and provide tips to improve your good credit score. It’s like having a supportive friend in your corner, cheering you on to credit success!

- Debt Settlement: We know, it sounds daunting, but debt settlement is like the heavy artillery when you’re facing a tough credit battle. In severe cases where you’re struggling with overwhelming debt, debt settlement may be an option to consider. It involves negotiating with creditors to settle your debts for less than what you owe. While it’s not a decision to take lightly, it can provide relief and a fresh start for your credit journey for creating good credit score.

Remember, seeking professional help is a sign of strength, not weakness. It shows that you’re proactive about improving your good credit score situation and taking charge of your financial future. Whether it’s credit counselling or debt settlement, these options are here to help you navigate the rough waters and set sail towards calmer credit seas. You’ve got a support team waiting to assist you, so don’t hesitate to reach out for a helping hand.

Understanding Credit Score Fluctuations

Hey there, credit score explorer! Did you know that good credit scores are a bit like roller coasters? They can go up and down, taking you on a ride of twists and turns. But fear not, understanding these fluctuations can be the key to keeping your good credit score on track. Let’s dive into the factors that cause these ups and downs:

- Hard Inquiries: Picture this you’re on a credit-seeking quest, applying for new credit cards or loans. While it’s exciting to discover new credit possibilities, each application triggers a hard inquiry on your credit report. These inquiries can temporarily nudge your credit score down a bit. But don’t worry, it’s just a minor dip, and your score will bounce back as you demonstrate responsible credit behaviour.

- Closing Accounts: We get it, saying goodbye to old credit accounts can be tough, like bidding farewell to old friends. But here’s the thing – closing accounts can impact your good credit score. It’s like trimming a tree branch; it shortens your credit history, which is a crucial factor in your score calculation. So, think twice before closing old accounts, especially if they have a positive payment history.

Remember, credit score fluctuations are a natural part of the credit journey. As you hop on and off the credit roller coaster, staying aware of these factors can help you maintain a healthy credit score. Embrace the ride, keep making those timely payments, and avoid unnecessary hard inquiries. Your credit score adventure will be smooth sailing!

Conclusion

Building and maintaining a good credit score from the start is a vital step toward financial stability. By understanding how credit scores work, using credit cards responsibly, and staying proactive in monitoring your credit, you can achieve a strong credit standing. Remember to avoid common credit pitfalls and seek professional help if needed. With the right approach and patience, you can build a solid credit foundation that will serve you well throughout your financial journey.

FAQs

Q: How long does it take to build a good credit score from scratch?

A: Building a good credit score takes time and discipline. It typically takes six months to a year to establish a credit history and see improvement in your score.

Q: Can I build credit without a credit card?

A: Yes, you can build credit without a credit card by becoming an authorised user on someone else’s card or taking a credit builder loan.

Q: Will checking my credit score frequently hurt my score?

A: No, checking your credit score through soft inquiries won’t hurt your score. It’s essential to monitor it regularly for accuracy.

Q: Is a credit score of 700 considered good credit score?

A: Yes, a credit score of 700 is generally considered good and puts you in a favourable position for credit approvals.

Q: Can I improve my credit score quickly?

A: Improving your credit score is a gradual process, but making timely payments and reducing credit card balances can have a positive impact in the short term.

Q: Should I close old credit card accounts?

A: Closing old credit card accounts can shorten your credit history, which may negatively affect your score. It’s generally better to keep them open.